How Ilan Shor Plans to Turn Rubles into Power in Moldova

A7A5 Updates - Moldova’s Hybrid Crypto Threat Evolves

In late June I published an article about Ilan Shor’s new cryptocurrency project, A7A5. In it we took a deep dive into the efforts by Shor and Russian state owned bank Promsvyazbank (PSB) to create a ruble-backed stablecoin - and why that is dangerous for Moldova. Since that time I’ve been tracking their efforts and talking to experts in the crypto analytics and blockchain intelligence space to better understand how this project has developed. Today we’re going to look at what they’ve been up to and the additional ways that A7A5 could threaten the integrity of Moldova’s parliamentary elections.

If you missed the original article - here it is:

The Rise of A7A5 - Elliptic’s Report

On July 28th blockchain analytics company Elliptic published a report on the rise of A7A5. In this report Elliptic tracks how A7A5 had grown in the prior months and hit multiple milestones. They report that A7A5 had hit an average of $1 billion dollars in daily transactions and a lifetime aggregate value of $41.2 billion in transactions. That refers to any movement of the coin within the crypto space - including peer to peer and wallet exchanges.

In terms of actual trades of A7A5, the report showed that the coin had reached a $150 million dollar daily trading volume. This specifically refers to users trading the ruble stablecoin A7A5 for the dollar-pegged stablecoin Tether (USDT). The report tracks a cumulative exchange volume of $8.5 billion dollars, though that refers to all exchange activity, not just USDT1.

A7A5 DEX

The key driver of this activity has been A7A5’s own distributed exchange (DEX). Elliptic reported that between July 11th and July 28th the company behind A7A5 had injected $1.2 billion dollars of USDT into this DEX. This often involved an injection of around $150 million dollars a day - as shown by this announcement.

This liquidity is then gobbled up by A7A5 traders eager to exit to USDT - often selling out the $150 million in USDT liquidity in under 10 minutes.

Let’s Break Down the Numbers and Crypto Jargon…

So what does this all mean? Before we get to that, keep in mind these facts from the last article I published:

A7A5 is a stablecoin pegged 1:1 to the ruble. This means that (in theory) every time you acquire A7A5 an equivalent amount of rubles are deposited in PSB bank to back the stablecoin.

A7A5 pays interest to holders. The war has driven Russian interest rates through the roof. The backers of A7A5 earn interest on all these rubles in PSB and share that interest with A7A5 holders 50/50. This comes in the form of new A7A5 coins issued as distributions. Elliptic now reports that over $4 million dollars worth of interest distributions had taken place by July 28.

USDT liquidity is key. A7A5 is designed as a sanctions evasion tool that will allow people to go outside the classic banking system in order to facilitate ruble trade with other currencies. It does this by trying to attract USDT investors to A7A5 with its “generous” interest rates. There are always rubles chasing dollars - there are not always dollars chasing rubles. Attracting USDT and getting listed on more exchanges is key.

So keeping that in mind, what Elliptic’s report is telling us is that the liquidity of the A7A5/USDT trading market has substantially risen. The more USDT there is demanding A7A5, the more exchanges might start listing A7A5 and the more confidence investors will have in this tool.

We covered that scenario in my last article. Basically, what happens if the kleptocratic startup called A7A5 attracts enough investment liquidity it could go “unicorn” - i.e spread across exchanges, develop a futures market and become a substantial crypto actor. In a word, what happens is “bad.”

So this all begs the question…

Where is the USDT Liquidity Coming From?

In order to better understand the growth that A7A5 is showing, and what this new liquidity means, I reached out to Elliptic with some questions. Namely - where is this USDT liquidity coming from and is it real, or wash trading?

Recall: A7A5 is issued by a Kyrgyz company called Old Vector LLC. It’s backed by the company A7, which is 51% owned by Ilan Shor and 49% by the bank PSB. Elliptic’s report shows an injection of $1.2 billion dollars in USDT buying A7A5. As we showed above, that is often from a daily advert of $150 million dollars in new liquidity that is rapidly exhausted. What I was trying to clarify is which of the following 2 options this represented:

Real liquidity - Old Vector LLC, A7, Ilan Shor, PSB or some combination of them all sold $1.2 billion dollars of USDT in exchange for A7A5.

Wash trades - Some combination of the above entities are both the seller and the buyer of at least some of that $1.2 billion. Meaning they are cycling USDT for A7A5 in loops to make it look like there is more trading activity (and liquidity) than there really is.

Reached for comment an Elliptic spokesperson familiar with the report replied to me the following:

"I don't believe that this is wash-trading. There seems to be genuine demand for USDT, and users are seemingly acquiring A7A5 in order to swap it for this USDT."

…

“it's A7A5 who is selling dollars for Rubles (A7A5 tokens) - through their DEX”

I also reached out to blockchain analytics Global Ledger for more information. They have also been following the rise of A7A5 and in particular the takedown of the Garantex exchange last spring by the US Secret Service, and its subsequent connection to Grinex2.

Global Ledger’s CEO Lex Fisun does believe that at least some of this is wash trading. In response to questions he explained the process writing:

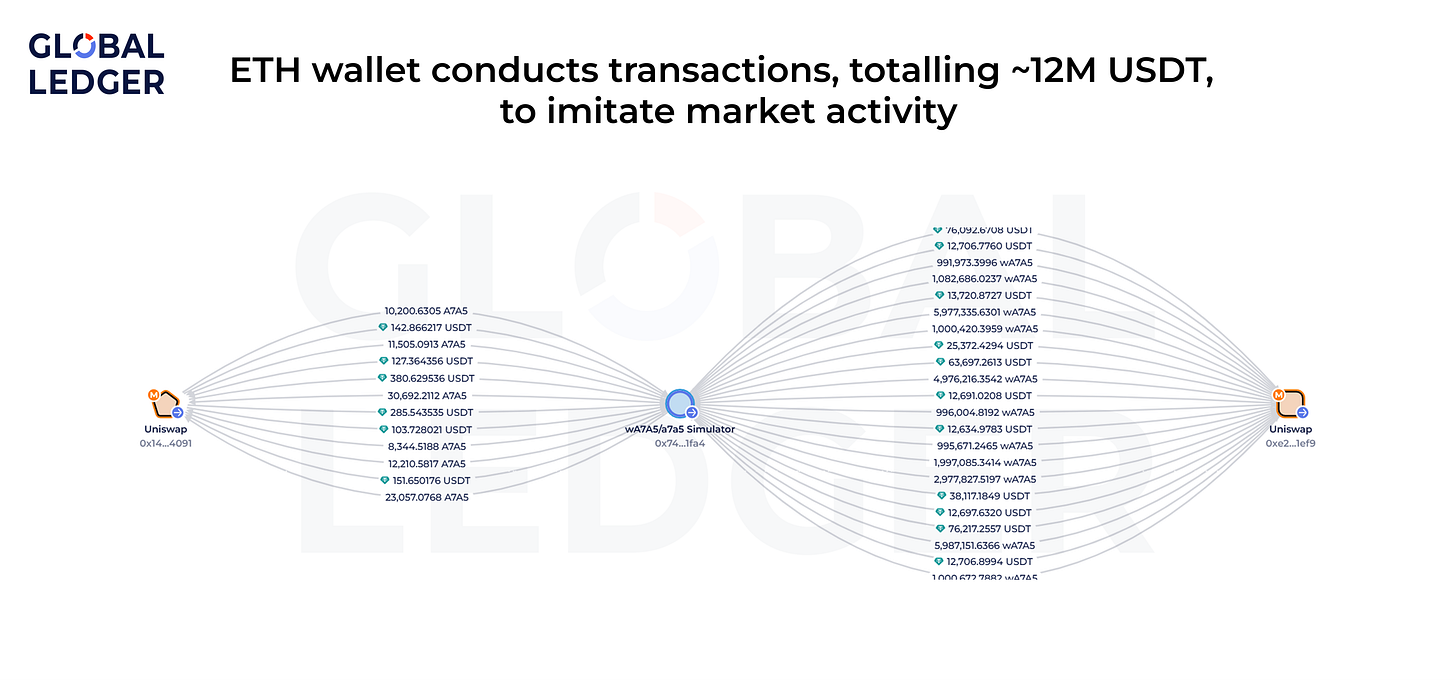

When the same wallet buys and then sells USDT for A7A5 in one or two transactions, it raises the perceived volume numbers without any new liquidity. This is a years-old technique to get attention and deceive people into believing that you have more liquidity than you really do. We have seen the same fake volume-raising trades to get attention to new or malicious exchanges, phishing coins, NFTs, and DeFi rug pulls. The pattern here is the same, though some analytics sources have emphasized the volume spike but not the details,”

A company spokesperson went on to note that they tracked 3 Ethereum wallets facilitating trades with one another to create the illusion of a bigger market. One of these wallets alone was responsible for thousands of transactions approximating $12 million dollars in value in USDT to A7A5 trades

They explained that when A7A5’s backers make liquidity announcements over Telegram (like the one shown above) wallets are already withdrawing USDT from this pool *before* the announcement is posted. Basically, when A7A5 holders are rushing to trade their coins for USDT they are being beat to it by the companies backing the currency itself. They are using the same money to simulate higher liquidity while also cheating A7A5 holders out of the liquidity that they were promised.

Explaining the scheme a Global Ledger spokesperson wrote:

“Unlike typical pump-and-dump schemes, A7A5 appears to be following a structured growth plan, leveraging both liquidity and marketing to position itself as a long-term player.”

Basically, while shady, this is a methodical strategy to increase the visibility to A7A5 and ultimately win it access to the larger exchanges that are necessary to build a real USDT-A7A5 liquidity pool.

So while Elliptic and Global Ledger differ on what this liquidity really represents, here’s the bottom line: either A7A5 is already gaining real market traction, or its backers are using fake trades and manufactured demand to lure in real investors as part of a calculated long-game. Either way, the threat is real.

A7A5 as a Voter Bribery Tool

In the previous article I explained how A7A5 could be a threat to Moldova’s elections. Basically, the purpose of the kleptocratic startup was sanctions evasion. Ilan Shor was helping build a financial pipeline for Russia to use, and in return would get some cut of the proceeds. Then, a portion of Ilan Shor’s earnings from this scheme would form a slush fund of election interference money. Basically, a sort of kleptocratic tax where the proceeds are dedicated to overthrowing Moldova’s government.

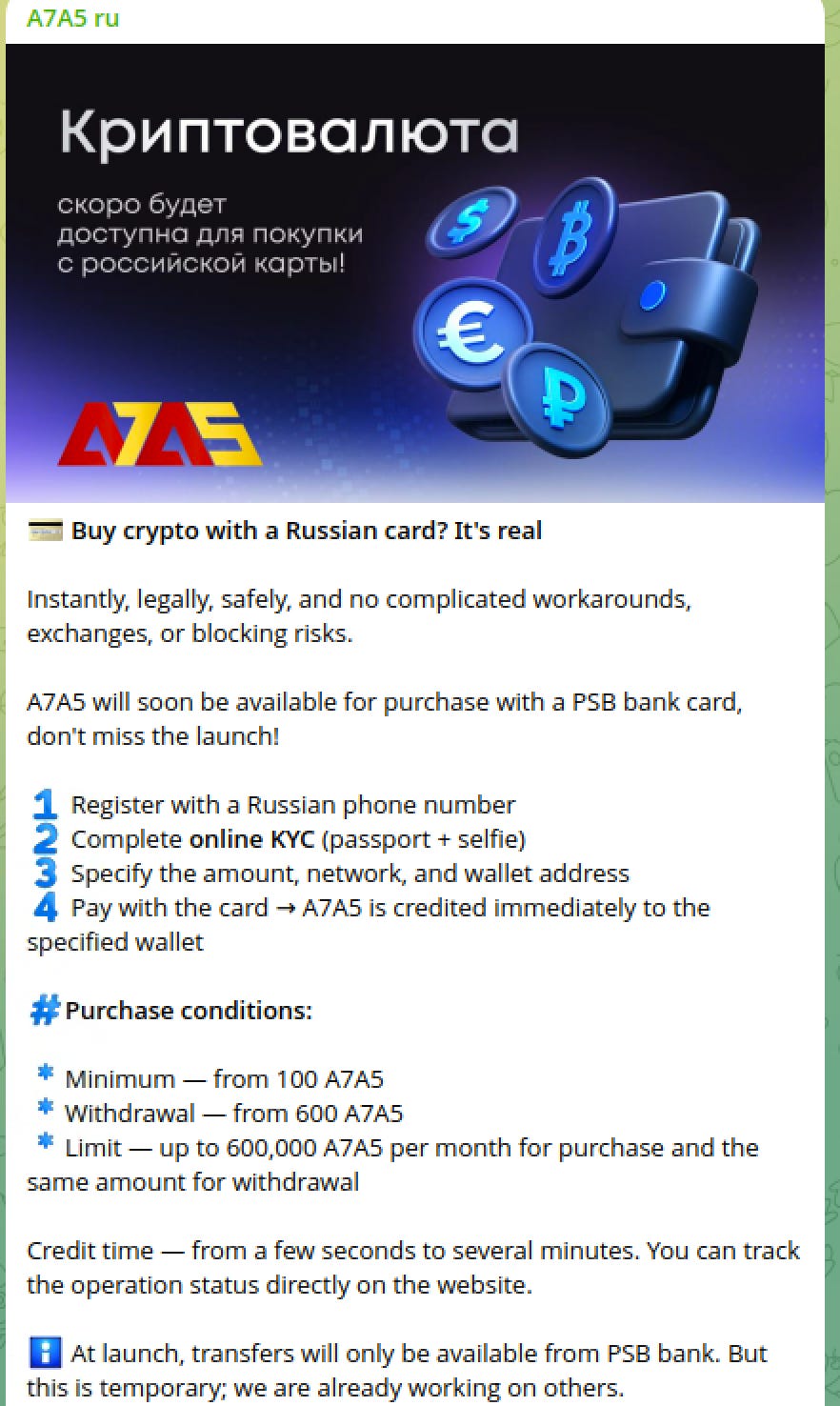

The Elliptic report highlighted a different and potentially much more concerning threat. Promsvyazbank has launched the ability to trade A7A5 from right within their PSB app. This feature went live on August 11th.

Why this is a problem for Moldova

In last year’s elections Ilan Shor’s network promised voters bribes for their votes, or payments for gamified actions (like paid protests). Many of these transactions were carried out via the PSB app. ZdG released a landmark investigation at the time which showed exactly how this functioned.

The problem with the arrangement was related to financial sanctions. Shor would open accounts for “activists” in PSB and then deposit some rubles into their accounts. But what then? You can’t withdraw rubles in Moldova or transfer them to a bank in a jurisdiction that upheld sanctions on Russia. It is possible to withdraw rubles in Transnistria, but the risks of going there just for an ATM led to lots of issues - and an almost farcical level of theft, as Shor’s acolytes robbed each other blind.

A7A5 could profoundly change this dynamic. Here’s how it would work: Shor’s team opens a PSB account for a paid protestor / bribed voter and deposits some rubles. This person can now buy A7A5 with these rubles and earn healthy interest until they are ready to cash out. When they are, they sell A7A5 for USDT, or a whole basket of other cryptocurrencies. These can then be used to cash out into lei, euros or dollars3.

The viability of this scheme depends on A7A5 achieving a certain amount of liquidity such that bribed voters and Shor network members can trade their coins for something they can turn into real money. Critically, the amount of liquidity needed for this is *far* less than A7A5 hopes to achieve in transactions involving sanctions evasion. Put simply, for them, using this as a voter bribery tool would just be an extra perk if things go according to plan.

Cop on the Beat - OFAC Sanctions A7A5

On August 14th the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) issued new sanctions targeting A7A5 and the companies and exchanges that support it. Specifically they targeted the exchanges Garantex and Grinex, Old Vector LLC, A7 LLC, A71 LLC, A7 Agent LLC and prominent individuals involved with these efforts. Ilan Shor and PSB are already under sanctions.

Sanctions should provide a serious deterrent against USDT holders, and Tether itself, from doing business with these entities. With that said, only time will tell how effective they will be. So far sanctions have forced reorganizations of exchanges and new tactics by A7 and PSB. At the same time, reports from Elliptic and Global Ledger have shown that those behind A7A5 have adapted to problems before and continued growing the coin.

Whether A7A5’s rapid growth is the result of organic demand or orchestrated manipulation, its trajectory poses real risks for Moldova. As the September elections near, Shor’s network appears to be laying the financial groundwork for new forms of influence and interference - using tools that are harder to interdict than those he’s used before. With US sanctions in place, the next few weeks will be a critical test of whether financial enforcement can outpace Shor’s financial “innovations” in Moldova’s hybrid war front.

We’ll see in the coming weeks how this cat and mouse game plays out.

Moldova Matters is a reader-supported publication. You can lock in a 15% discount if you get a yearly subscription before August 31st! It’s a great way to get all Moldova Matters content and to support the work that goes into this newsletter!!

So it could include bitcoin or other crypto exchanges as well

Moldova does not currently have any official crypto ATMs or similar infrastructure - but it’s there. Even if they can’t do it in Moldova these services are widely available (and legal) all around the world. Shor might again resort to bundlers to gather A7A5 up and pass out cash, or some other scheme. It’s not a perfect tool - but its way better than going to Transnistria.

Great article! Im sure you have seen that the UK government has just sanctioned A7A5 along with various related entities. What’s your view of the effectiveness of these sanctions? Keep up the good work!

It was a while back but when I was working for UK banks, keeping OFAC happy was an absolute requirement. They could basically shut down your access to US Banking if you didn't comply visibly and comprehensively in blocking anyone they wanted blocking.

This included stuff like alternate spelling of sanctioned organisations and people.

This included that UK banks should be able to demonstrate that the had the plans and capacity to do OFAC checks at scale, and at speed. Designed to stop an ENRON scandal from happening again, (save money by bad capacity planning in brief).

The specifics may have changed since then, but the requirement was roughly to be able to handle a rate 3x that of the peak day, without compromising OFAC checks. (This was where I came in as a performance and capacity specialist). These requirements were public, as the whole point was to build confidence in the banking systems.

Now the whole point of the crypto is to get around this, but it should be VERY effective in terms of stopping banks of any size from touching it with a bargepole.